Big Good News for Farmers: Up to Rs 2 Lakh Loan Waived Under KCC Scheme!

Farmers across India are smiling today as the government has brought a big relief. The Kisan Credit Card (KCC) Loan Waiver Scheme is here to help small farmers who are struggling with loans. Under this plan, loans up to Rs 2 lakh will be fully waived off. This means no more worry about paying back that money. The scheme is part of the government’s effort to support agriculture and make sure farmers can focus on growing crops without debt hanging over their heads. Many farmers have already started checking if they qualify, and the news is spreading fast in villages.

What is the KCC Loan Waiver Scheme?

The KCC Loan Mafi Yojana 2025 is a special program launched by the central government to forgive farm loans. It targets small and marginal farmers who took loans through Kisan Credit Cards from government or cooperative banks. The main goal is to reduce the financial burden on these hardworking people. According to official details, the scheme started last year but has been updated for more coverage this year. Over seven crore farmers might benefit from it, helping them invest in better farming tools and seeds. This waiver applies only to loans taken after November 30, 2018, and not from private lenders.

Who Can Get This Benefit?

Not every farmer can get the waiver; there are some rules to follow. Farmers must have less than two acres of land to be eligible. Even if they missed some loan payments, they can still apply. But the loan should be from approved banks only. Families depending on farming as their main job will get priority. This scheme is open across states, but farmers should check with their local agriculture office for any extra state rules.

Here are the main eligibility points in a simple way:

Own less than 2 acres of farmland.

Loan taken after November 30, 2018.

Loan from government banks or cooperatives.

No waiver for private loans.

Farmers who defaulted on payments are also okay.

| Eligibility Criteria | Details |

|---|---|

| Land Ownership | Less than 2 acres |

| Loan Date | After Nov 30, 2018 |

| Loan Source | Govt banks/cooperatives |

| Max Waiver Amount | Rs 2 lakh |

How to Apply for the Waiver?

Applying is easy and done online to save time. Farmers need to go to the official KCC loan portal on their phone or computer. First, register with basic details like name and Aadhaar number. Then, fill the form and upload papers such as Aadhaar card, bank passbook, land papers, and KCC loan proof. After submitting, they get a registration number to track progress. No need to visit offices many times; everything is digital now. If someone does not have internet, they can ask help from local common service centers.

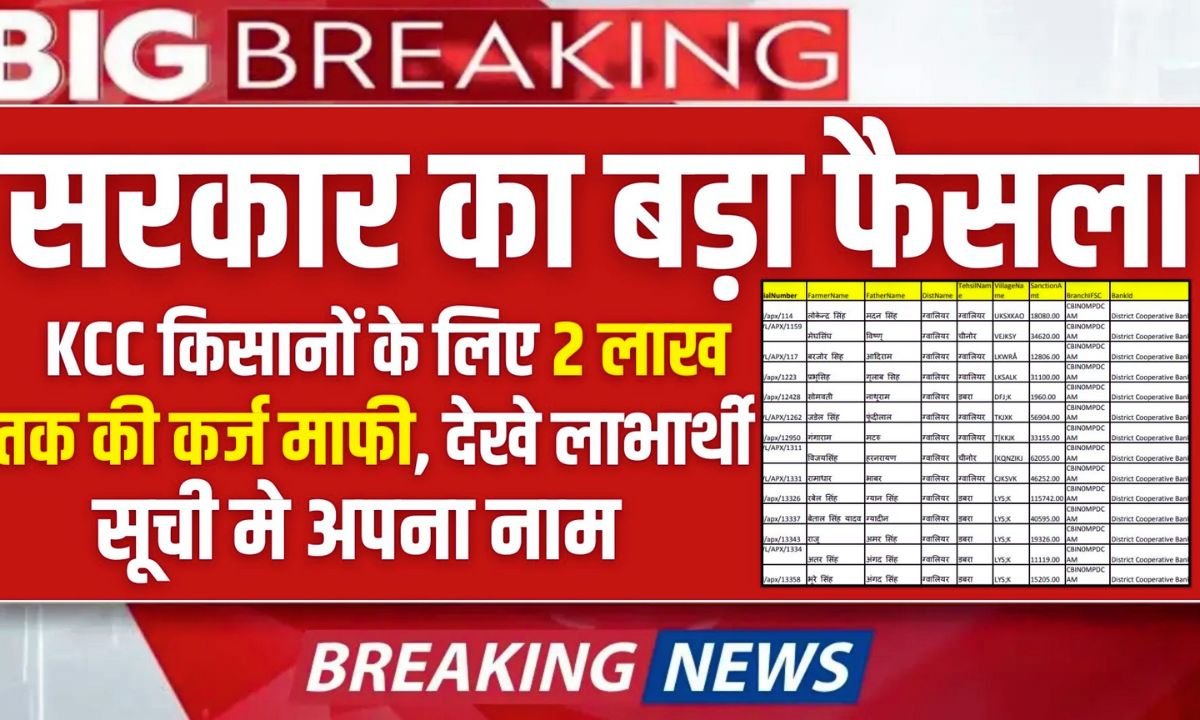

How to Check If Your Name is in the List?

Once applied, farmers want to know if their loan is waived. The government has released beneficiary lists online. To check, visit the same portal and go to the status section. Enter your registration number, bank name, and district. The list will show if your name is there. Lists are updated regularly, so check often. If not selected, there might be a way to appeal or correct mistakes. This transparency helps avoid any cheating.

Why This Scheme is a Game Changer for Farmers?

This waiver is like a fresh start for many families. With no debt, farmers can buy good quality seeds, fertilizers, and even small machines. It will boost crop production and make villages stronger. The government says this will also help in food security for the whole country. But remember, guidelines can change, so always look at the Ministry of Agriculture website for latest news. Farmers are hopeful this will bring better days ahead.

(Word count: 582)

Farmers across India are smiling today as the government has brought a big relief. The Kisan Credit Card (KCC) Loan Waiver Scheme is here to help small farmers who are struggling with loans. Under this plan, loans up to Rs 2 lakh will be fully waived off. This means no more worry about paying back that money. The scheme is part of the government’s effort to support agriculture and make sure farmers can focus on growing crops without debt hanging over their heads. Many farmers have already started checking if they qualify, and the news is spreading fast in villages.

What is the KCC Loan Waiver Scheme?

The KCC Loan Mafi Yojana 2025 is a special program launched by the central government to forgive farm loans. It targets small and marginal farmers who took loans through Kisan Credit Cards from government or cooperative banks. The main goal is to reduce the financial burden on these hardworking people. According to official details, the scheme started last year but has been updated for more coverage this year. Over seven crore farmers might benefit from it, helping them invest in better farming tools and seeds. This waiver applies only to loans taken after November 30, 2018, and not from private lenders.

Who Can Get This Benefit?

Not every farmer can get the waiver; there are some rules to follow. Farmers must have less than two acres of land to be eligible. Even if they missed some loan payments, they can still apply. But the loan should be from approved banks only. Families depending on farming as their main job will get priority. This scheme is open across states, but farmers should check with their local agriculture office for any extra state rules.

Here are the main eligibility points in a simple way:

Own less than 2 acres of farmland.

Loan taken after November 30, 2018.

Loan from government banks or cooperatives.

No waiver for private loans.

Farmers who defaulted on payments are also okay.

| Eligibility Criteria | Details |

|---|---|

| Land Ownership | Less than 2 acres |

| Loan Date | After Nov 30, 2018 |

| Loan Source | Govt banks/cooperatives |

| Max Waiver Amount | Rs 2 lakh |

How to Apply for the Waiver?

Applying is easy and done online to save time. Farmers need to go to the official KCC loan portal on their phone or computer. First, register with basic details like name and Aadhaar number. Then, fill the form and upload papers such as Aadhaar card, bank passbook, land papers, and KCC loan proof. After submitting, they get a registration number to track progress. No need to visit offices many times; everything is digital now. If someone does not have internet, they can ask help from local common service centers.

How to Check If Your Name is in the List?

Once applied, farmers want to know if their loan is waived. The government has released beneficiary lists online. To check, visit the same portal and go to the status section. Enter your registration number, bank name, and district. The list will show if your name is there. Lists are updated regularly, so check often. If not selected, there might be a way to appeal or correct mistakes. This transparency helps avoid any cheating.

Why This Scheme is a Game Changer for Farmers?

This waiver is like a fresh start for many families. With no debt, farmers can buy good quality seeds, fertilizers, and even small machines. It will boost crop production and make villages stronger. The government says this will also help in food security for the whole country. But remember, guidelines can change, so always look at the Ministry of Agriculture website for latest news. Farmers are hopeful this will bring better days ahead.